To fully grasp “What are ETFs in India?” and how they operate, let’s start by exploring the fundamentals of ETFs and in this blog I will be uncovering all the things you must know to do strategic investment in ETFs and drive a good return out of it in short interval of time.

As an ETF investor myself, I’m excited to share one of my personal strategies with you at the end of this blog – a strategy that helped me earn a profit of Rs 1,00,000 on a Rs 2 Lakh investment in just 6 months.

Topic that are uncovered in this blog post includes:

- What Are ETFs in India?

- Advantages of ETFs over stocks in India

- Types of ETF in India

- What do I need to invest in ETF for beginners?

To do that in this blog I will be covering about all the essential that you must know before investing in ETFs. So lets start by knowing about ETFs in India

What Are ETFs in India?

Table of Contents

- 1 What Are ETFs in India?

- 2 Types of ETF in India:

- 3 What do I need to invest in ETF for beginners?

- 4 Best platform to buy ETF in India (Beginners & Expert)

- 5 How to open demat account in zerodha step by step:

- 6 What to look for when choosing a ETF?

- 7 How to buy ETFs in Zerodha?

- 8 Here are steps that I follow for Investing in ETFs:

- 9 FAQ questions related to ” What are ETFs? “

First of all ETF stands for Exchange-traded funds (ETFs) and they are considered as a type of mutual fund that can be bought and sold like a stock exchange during market hours(9:00 AM to 3:30 PM).

ETFs are considered as a simple investment option for retail investors and can offer several benefits, including:

- Dynamic and real-time pricing

- Low costs

- Cost-efficient for passive portfolios

- Diversification

- Potential to lower risk

ETFs are similar to managed funds as they invest in a group of stocks. However, unlike managed funds, ETFs can be traded throughout the day, similar to stocks.

ETFs can be actively or passively managed, and when passively managed, they replicate a market index, such as a stock index, bond index, or commodity index.

Advantages of ETFs over stocks in India:

There are several advantages of buying ETFs over stocks in 2024. Among these, I have highlighted some of the major advantages of investing in ETFs this year.

- Diversification

- Liquidity

- Transparancy

- Tax efficiency

- Low Cost

- Accessibility

- Low fees

Now since we have known the advantages of buying an ETFs now lets move on to our next question that are “What are ETFs types available in India?”

Types of ETF in India:

ETFs are mainly grouped by the type of stocks they hold and the index they follow. Based on this, ETFs are divided into eight categories.

- Index ETFs

- Fixed Income ETFs

- Commodity ETFs

- Leverage ETFs

- Style ETFs

- Foreign Market ETFs

- Inverse ETFs

- Equity ETFs

So those of you who don’t know about I have provided you a brief intro o0n thwe types of ETFs so please consider to have a look:-

- Index ETFs: Track the performance of a specific index, such as the Nifty 50.

- Fixed Income ETFs: Focus on bonds and other fixed-income securities, providing steady income.

- Commodity ETFs: Invest in physical commodities like gold, oil, or agricultural products.

- Leverage ETFs: Use financial derivatives and debt to amplify the returns of an index.

- Style ETFs: Follow specific investment styles, such as growth or value stocks.

- Foreign Market ETFs: Invest in stocks or assets from international markets.

- Inverse ETFs: Aim to profit from the decline of an index by moving in the opposite direction.

- Equity ETFs: Invest in a basket of stocks, aiming to mirror the performance of a specific stock index.

If, after reading this blog, you’re ready to try your hand at investing in ETFs, here are the essential things that you’ll need to get started.

What do I need to invest in ETF for beginners?

To kickstart your journey as an ETF investor, you must have these three essentials:

- A Bank Account

- A Demat Account

- A minimum capital of Rs 1-2 Lakhs

Among these, selecting a good Demat account is crucial for seamless transactions and safekeeping of your ETF investments to do that lets found out the answer for this crucial question on “what are ETFs best trading platforms?” in the next part of the blog.

Best platform to buy ETF in India (Beginners & Expert)

Although there are many platforms available in India to buy ETFs, we will only be discussing the top five. At last I will be share my personal favorite platform, which I use to buy ETFs.

Top 5 platform to buy ETF in India from NEC

- Zerodha

- Groww

- 5 paisa

- Angel One

- kotak Mahindra Bank

“Among them, Zerodha is my personal favorite, and I have been using it continuously for two years due to its smooth fund transactions, low brokerage costs, and quick buying and selling features. Additionally, Zerodha offers a wide variety of free tools that help with both fundamental and technical analysis of stocks.”

“Once you have selected the right broker or service provider, let’s go through the steps on how to open a Demat account. Since I am a Zerodha user myself, I can guide you through the process of opening a Zerodha account, the required documents, and the charges involved.

But don’t worry if you’ve chosen another service provider instead of Zerodha—the process is almost the same for all Demat account providers. However, in my opinion, Zerodha offers the best services.”

How to open demat account in zerodha step by step:

Zerodha offers two apps for investment: the Coin app for mutual fund investments, and the Kite app for shares, equity, ETFs, and other investments. For investing in ETFs, you need to create an account on the Kite app.

The process of opening an account in Zerodha is divided into 14 steps, which are as follows:

- Step 1 = Download kite app from play store and open it in your mobile phone.

- Step 2 = Now enter your phone no. and click continue

- Step 3 = now fill the information and click on continue button

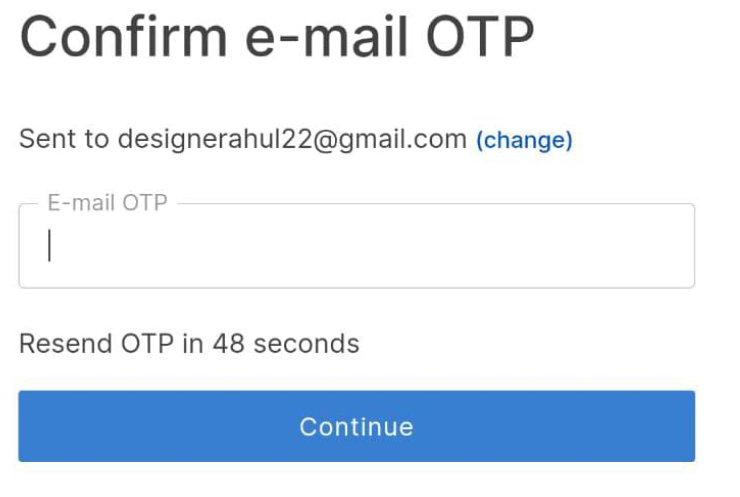

- Step 4 = one OTP will appear on your registered email id so conform it and click on continue button

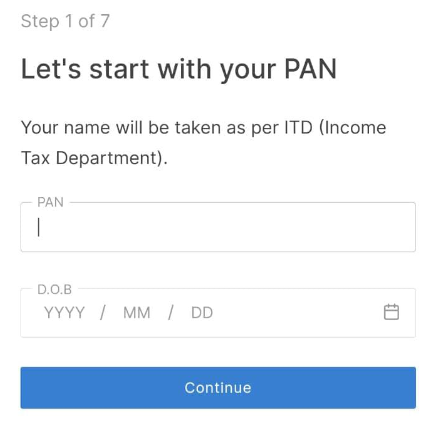

- Step 5 = After sign up now lets fill your PAN details and Date of Birth (DOB)

- Step 6 = Now in step 6 pay account opening fees which is roughly Rs 200

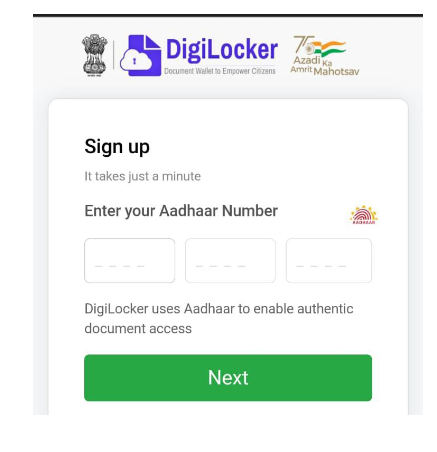

- Step 7 = Now its time to do the KYC verification using DigiLocker

- Step 8 = Enter your “Aadhaar card number”

- Step 9 = Verify your Aadhaar OTP

- Step 10 = Now in this steps you have to make a profile by first providing your parent information like first name and last name

- Stem 11 = Now in this step you have to link your Bank account for fund transfer from your bank account to demat account

- Step 12 = In this step you have to do the webcam verification where first Kite app will provide you with a number write it in a sheet of paper and then appear in the box appearing in kite app and click a photo

- Step 13 = Upload your digital signature

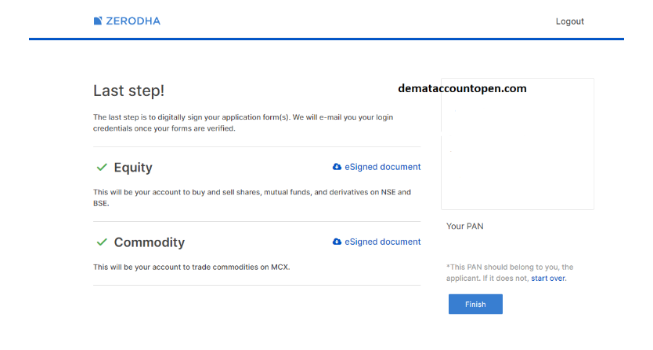

- Step 14 = This is the last step in opening a account in Zerodha kite app this step you have to check for account opening conformation and collect the documents of your account

“Now that you have successfully created a Demat account in the Zerodha Kite app, it’s time to learn about the What are ETFs tick and tricks that we must look before buying as ETFs?”What are ETFs buying process, which I will be discussing in the next part of the blog.”

What to look for when choosing a ETF?

Before choosing a these points should be taken into consideration which can definitely have have a huge impact on your returns some of this parameters include

- Expense Ratio

- Tracking Error

- Underlying Index and Stock Weighting

- Assets Under Management (AUM)

- Fund Issuer

- Liquidity

- Volume

- Dividend Distribution

- Historical Performance

- Tax Efficiency

These are important factors to review when selecting the right ETF for your portfolio in 2024.Now moving on to the next part where we will be discussing about “What are ETFs buying process, which I will be discussing in the next part of the blog.”

How to buy ETFs in Zerodha?

Buying ETFs in Zerodha is simple and it could be done in 3 easy steps they are:-

- Step 1 = Select the ETFs that you want to buy in the watch list of Zerodha kite app.

- Step 2 = Then click on the selected stock and press buy button on the left hand side of the screen.

- Step 3 = Select the quantity that you want to purchase and along with that also select the price at which you want to purchase the ETF.

- Step 4 = Then shift the slider from left to right to conform the purchase.

- Step 5 = Ones that price hit the market your ETFs will be automatically purchased.

But If you want to know this whole process in detail then you can visit Zerodha official website where they have clearly explained all the ways of buying an ETFs using Zerodha kite app along with that they have provided the NSE official details about ETF link in form of PDF.

Here are steps that I follow for Investing in ETFs:

- Step 1= Fix the capital that you want to invest

- Step 2= Let us assume that you investing capital is Rs 2,00,000

- Step 3= Divide the total capital into 60 equal parts which will be roughly equal to Rs 3333.

- Step 4= Then for 60 days buy at least one ETF every day and create a stock list

- Step 5= Then sell each ETF at a profit of 6-7 Percent.

- Step 6= Then repeat this same process again and again with the compounded price.

There is only one precaution that You should follow while investing in ETFs using one strategy that you should always buy ETFs at 25 days lower price to generate maximum return.

Do I need a Demat account for ETF?

Yes it is mandatory to have an demat account for buying of ETFs but take it into consideration that the brokerage of the account should be low.

What is the brokerage of Zerodha for ETFs in India?

Zerodha charges us 0.25 percent on profit booking and 18% GST on the amount Invested.

If you enjoyed this blog and would like to read more similar posts, here are the top 4 posts on my website. Take a moment to visit them and let me know in the comments if you find them interesting.

- Pizza Galleria Profile: Gohana Brand (2015-2024) Detailed Overview

- Stage Company Profile:An Ott Platform Overview (2019 to 2024)

- Pizza Galleria Profile: Gohana Brand (2015-2024) Detailed Overview

- Jain Shikanji Company Profile: with Shark Tank updates till 2024