In this blog on the “HDFC FlexiCap Fund Growth Overview,” we’ll explore all the key details you need to know, making it easier for you to plan your investments and set yourself on the path to becoming a future crore Pati.

Things that we will be covering in this blog are:

- What is HDFC Flexi Cap Fund?

- Things To know Before Investing In HDFC Flexi Cap Funds India

- NAV of HDFC Flexi Cap Fund Growth

- How Are The Returns Of HDFC Flexi Cap Fund Growth?

- How To Invest In HDFC Flexi Cap Fund?

HDFC FlexiCap Fund Growth Overview:

Table of Contents

- 1 HDFC FlexiCap Fund Growth Overview:

- 2 What Is HDFC Flexi Cap Fund?

- 3 Things To know Before Investing In HDFC Flexi Cap Funds India:

- 4 NAV of HDFC Flexi Cap Fund Growth:

- 5 How Are The Returns Of HDFC Flexi Cap Fund Growth?

- 6 How To Invest In HDFC Flexi Cap Fund?

- 7 How to Invest In Mutual Funds Online In India For Beginners?

- 8 How To Invest Lumpsum Amount In HDFC Mutual Fund?

- 9 How To Invest In SWP Mutual Fund In Zerodha?

- 10 How To Buy Mutual Funds SIP In Zerodha?

- 11 FAQ questions on HDFC FlexiCap Fund Growth Overview:

Here’s a brief table summarizing key details about the HDFC Flexi Cap Fund:

| Parameter | Details |

|---|---|

| NAV | ₹85.12 (as of September 20, 2024) |

| Returns | 1 Year: 44.02% 3 Years: 27.15% 5 Years: 24.97% Since Launch: 19.4% |

| Expense Ratio | 1.44% (as of August 31, 2024) |

| Exit Load | 1% if redeemed within 1 year |

| Minimum Investment | ₹100 (minimum additional investment: ₹100) |

| Benchmark | NIFTY 50 – TRI (primary), NIFTY 500 – TRI (secondary) |

| Investment Portfolio | Predominantly in equity and equity-related instruments |

Let’s kick off this blog and dive into everything you need to know about the “HDFC FlexiCap Fund Growth Overview.” But before we explore the key factors to consider before investing, let’s start with a quick introduction to this fund.

What Is HDFC Flexi Cap Fund?

HDFC Flexi Cap Fund is a type of mutual fund managed by the expert fund managers of the HDFC Group.

Compared to other funds, it carries relatively lower risk while offering the potential for medium to high returns, making it an attractive option for investors looking for a balance between growth and stability.

This is made possible by the fund’s ability to invest flexibly across large-cap, mid-cap, and small-cap stocks. The HDFC Flexi Cap Fund skillfully navigates changing market conditions, ensuring a well-diversified portfolio that balances risk and reward.

It’s an excellent choice for investors with a long-term outlook, aiming for steady performance without exposing their investments to undue risk.

Things To know Before Investing In HDFC Flexi Cap Funds India:

Before diving into any mutual fund investment, there are several factors to weigh, but when it comes to the HDFC Flexi Cap Fund investment, here are some key considerations you won’t want to overlook:

- Expense Ratio

- Investment Objective

- Investment Management

- Fund Performance

- Investment Strategy

- Taxes

- Direct Plans

- Fund Type

For those who may not be familiar with these terms and what they mean, I’ve provided brief explanations to clarify any doubts new investors might have before investing in the HDFC Flexi Cap Fund Growth.

Brief On Important Factors To Consider Before Selection Of Fund:

Here’s a brief explanation of the key terms related to the HDFC Flexi Cap Fund:

- Expense Ratio: This represents the percentage of the fund’s assets that go towards management and operational costs. A lower expense ratio means more of your investment is working for you.

- Investment Objective: This defines what the fund aims to achieve, such as long-term capital appreciation or wealth creation, guiding the fund’s investment decisions.

- Investment Management: This refers to the team of professionals responsible for making investment decisions on behalf of the fund, focusing on maximizing returns while managing risks.

- Fund Performance: This measures how well the fund has done over time, usually compared to a benchmark index. It helps investors assess the fund’s historical returns.

- Investment Strategy: This outlines how the fund plans to achieve its objectives, including the types of assets it invests in (large-cap, mid-cap, small-cap) and its approach to market fluctuations.

- Taxes: This includes the tax implications on any gains made from the fund, differentiating between short-term and long-term capital gains, which can affect your overall returns.

- Direct Plans: These are investment options that allow investors to buy mutual fund units directly from the fund house, often at a lower cost than regular plans, as they bypass intermediaries.

- Fund Type: This specifies the category of the fund, in this case, a Flexi Cap mutual fund, which invests in stocks of companies across various market capitalizations for better diversification.

Now that we’ve covered the key factors to consider when selecting a fund, let’s move on to the next important topic in our “HDFC FlexiCap Fund Growth Overview.” Here, we’ll discuss crucial considerations to keep in mind when investing in this fund.

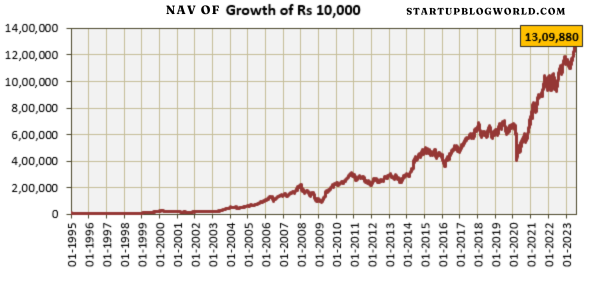

NAV of HDFC Flexi Cap Fund Growth:

NAV is considered one of the most important factors to evaluate when investing in any fund, as it directly impacts the returns on your initial investment.

Simply put, NAV stands for Net Asset Value, which represents the value of an investment fund or mutual fund. It’s calculated by subtracting the fund’s liabilities from its assets and then dividing that result by the number of outstanding shares. Understanding NAV helps investors gauge the fund’s performance and make informed decisions.

Currently, the NAV of the HDFC Flexi Cap Fund is fluctuating between a Daily Moving Average (DMA) of ₹1,825 and ₹1,950 for September 2024. This range indicates the fund’s recent performance and can help investors assess its trends and make informed investment decisions.

HDFC Flexi Cap Fund NAV History:

For this blog on the HDFC FlexiCap Fund Growth Overview, I have shared the NAV for the current month. Please find the table below:

| Date | NAV (₹) |

|---|---|

| 20-09-2024 | 1950.521 |

| 19-09-2024 | 1926.104 |

| 17-09-2024 | 1927.734 |

| 16-09-2024 | 1922.794 |

| 13-09-2024 | 1920.593 |

| 12-09-2024 | 1923.38 |

| 11-09-2024 | 1896.346 |

| 10-09-2024 | 1900.896 |

| 09-09-2024 | 1886.839 |

| 06-09-2024 | 1883.498 |

| 05-09-2024 | 1901.579 |

| 04-09-2024 | 1903.492 |

| 03-09-2024 | 1902.935 |

| 02-09-2024 | 1898.453 |

| 30-08-2024 | 1894.811 |

| 29-08-2024 | 1881.005 |

| 28-08-2024 | 1879.071 |

| 27-08-2024 | 1877.188 |

| 26-08-2024 | 1871.309 |

| 23-08-2024 | 1859.872 |

| 22-08-2024 | 1862.221 |

| 21-08-2024 | 1856.276 |

| 20-08-2024 | 1850.183 |

Having understood the importance of NAV when investing in the “HDFC Flexi Cap Fund,” it’s now time to move on to the next section of our blog on HDFC FlexiCap Fund Growth Overview. Here, we’ll explore the returns that you could expect in one to five years of Investment.

How Are The Returns Of HDFC Flexi Cap Fund Growth?

Before we dive into the returns of the HDFC Flexi Cap Fund Growth, let me emphasize one key point: if you’re considering investing in this fund, I strongly recommend a long-term approach.

This way, you’ll be able to fully harness the power of compounding, which can significantly enhance your returns over time. Investing with a long-term horizon is the best way to truly maximize the potential of this fund.

Return of HDFC Flexi Cap Fund Growth:

| Time Period | Return |

|---|---|

| 1 year | 44.02% |

| 3 years | 27.15% |

| 5 years | 24.97% |

| Since launch | 19.4% |

Now that we’ve seen the fund’s returns, let’s move on to the HDFC Flexi Cap Fund Growth Overview, where we’ll explore the best investment strategies to maximize your returns.

How To Invest In HDFC Flexi Cap Fund?

There are two ways of safely investing in HDFC Flexi Cap Fund to drive better return from you investment the details of these two methods are listed below for your better understanding.

There are two primary ways to invest in the HDFC FlexiCap Fund:

- Online Method: This allows investors to conveniently purchase units through the fund’s website or various investment platforms, providing easy access and real-time tracking.

- Offline Method: Investors can also choose to invest through traditional channels, such as visiting a bank branch or financial advisor, where they can fill out the necessary forms and submit them in person.

For this blog about HDFC FlexiCap Fund Growth Overview I am only providing details on how to invest in this fund by online method since the offline method is to risky for new Investors.

If you prefer to invest offline, it’s a great idea to find a trusted fund manager in your area. Just make sure to do your homework—research their background and track record thoroughly before making any investment decisions. This way, you can ensure your money is in reliable hands.

How to Invest In Mutual Funds Online In India For Beginners?

The online method of buying funds is subdivided into three parts that is:-

- Direct Buying/Lump sum method

- SWP (Systematic Withdrawal Plan)

- SIP (Systematic Investment Plan)

As a fellow Zerodha user, I’m happy to walk you through the steps I follow to invest in mutual funds. While each service provider may have slight variations, the overall process is quite similar.

How To Invest Lumpsum Amount In HDFC Mutual Fund?

Here are the steps on how to do Lumpsum investment in HDFC FlexiCap Fund Growth in Zerodha :

- Identify an appropriate scheme.

- Opt for a well-established fund house.

- Set up a mutual fund account.

- Decide on the investment amount.

- Move funds from your bank account.

- Consistently track the fund’s performance.

How To Invest In SWP Mutual Fund In Zerodha?

Here’s how you can create a Systematic Withdrawal Plan (SWP) for a mutual fund on Zerodha:

- Select “Investments” – Go to the “Investments” section in your Zerodha account.

- Choose your fund – Pick the mutual fund from your portfolio that you want to set up an SWP for.

- Tap on ፧ (options) – Click on the three-dot menu next to the fund.

- Select “SWP” – From the options, choose the “SWP” (Systematic Withdrawal Plan) feature.

- Enter the withdrawal amount – Specify the amount you wish to withdraw periodically.

- Set withdrawal frequency – Choose how often you want the withdrawals (monthly, quarterly, etc.).

- Tap “Create SWP” – Finally, tap “Create SWP” to activate the plan.

How To Buy Mutual Funds SIP In Zerodha?

Here’s how you can start a SIP on the Coin app using Zerodha:

- Log in – Use your Zerodha Kite credentials to log in to the Coin app.

- Search for the mutual fund – Look for the mutual fund you wish to invest in.

- Select “SIP” – On the fund’s page, tap “SIP” at the bottom.

- Enter SIP details – Input the amount, frequency, and start date for your SIP.

- Create and confirm – Click “Create SIP” and confirm your transaction.

Now that we’ve addressed the last and most crucial question, it’s time to conclude this blog with the most frequently asked FAQ questions on HDFC FlexiCap Fund Growth Overview, ensuring you have no doubts about investing in it.

FAQ questions on HDFC FlexiCap Fund Growth Overview:

What is the AUM of HDFC Flexi Cap Fund?

As of September 21, 2024, the Assets Under Management (AUM) of the HDFC Flexi Cap Fund Growth stands at ₹63,436.49 crore.

Is it good to invest in HDFC Flexi Cap Fund?

Yes it is good top Invest in HDFC Flexi Cap Fund because of its higher return and low risk factor

Is there any lock-in period for HDFC Flexi Cap Fund?

No, HDFC Flexi Cap Fund does not have a locking period and this is one of the other reason to Invest in this fund

If you enjoyed this blog and would like to read more similar posts, here are the top 2 posts on my website. Take a moment to visit them and let me know in the comments if you find them interesting.

- What is Gold ETF In India?|Meaning| Types|Account opening & Investment Process

- What Are ETFs In India?|Meaning| Types|Account opening & Investment Process

- Detail Info Of Top Questions on Quant Small Cap Funds 24