To fully grasp “What is gold ETF in India?” and how they operate, let’s start by exploring the fundamentals of gold ETF and in this blog I will be uncovering all the things you must know to do strategic investment in gold ETF and drive a good return out of it in short as well as long interval of time.

Here’s a more polished and engaging version of your sentence:

As an investor in ETFs myself, I’ve drawn from my experience to share insights on Gold ETFs in this blog. While gold has been a traditional investment for centuries, the landscape has evolved with the emergence of various schemes.

Among these, Gold ETFs stand out, offering the potential for higher returns compared to conventional gold investments. So let’s start the blog by first knowing what is gold ETF and what are the benefits of investing in gold ETFs.

What is gold ETF in India?

Table of Contents

- 1 What is gold ETF in India?

- 2 Benefits of investing in gold ETF in India

- 3 How to choose best gold ETF in India?

- 4 Best platform to buy gold ETFs in India:

- 5 List of things to have to buy gold ETF in Zerodha:

- 6 How to buy gold ETF in Zerodha?

- 7 Which gold ETF is best in India?

- 8 List of 5 Best Gold ETFs in India:

- 9 Best gold ETFs in zerodha:

- 10 FAQ question:

In India gold ETF could be considered as entity that works similar to mutual funds in some ways by investing in a group of gold assets while simultaneously tracking the price of domestic physical gold.

Gold ETFs are traded on stock exchanges just like individual stocks and can be held in either dematerialized or paper form. Each unit of a Gold ETF represents one gram of 99.5% pure gold, securely stored in a custodian bank vault. The value of each unit is based on the value of the physical gold it represents.

Gold ETFs offer a hassle-free way for investors to track real-time gold prices while keeping commission costs low. With a simpler trading process compared to buying physical gold, they’re an appealing option for those looking to invest in gold with ease and efficiency.

Now lets move on to the next topic where I have discussed “What is gold ETFs investment benefits?” that might drastically clear your minds for investing in gold ETFs then Physical Gold.

Benefits of investing in gold ETF in India

There are many benefits of investing in Gold ETFs compared to buying physical gold; some of these benefits are listed below.

- Liquidity and Accessibility

- Cost Efficiency

- Purity Assurance

- Portfolio Diversification

- No Wealth Tax

- Small Investment Requirement

- Ease of Trading

- Transparency

For those who may not fully understand these points, don’t worry! I’ve provided a brief introduction to each one to help you clearly grasp the benefits of investing in Gold ETFs compared to physical gold.

Investing in Gold ETFs in India offers several benefits:

- Liquidity and Accessibility: Gold ETFs can be easily bought and sold on stock exchanges, providing high liquidity. This allows investors to enter and exit positions swiftly compared to physical gold.

- Cost Efficiency: Investing in Gold ETFs eliminates the need for storage and security costs associated with physical gold. Additionally, there are no making charges, and the commission fees are generally lower.

- Purity Assurance: Each unit of a Gold ETF represents 99.5% pure gold, ensuring that your investment is in high-quality gold without any concerns about adulteration or purity.

- Portfolio Diversification: Gold ETFs offer an effective way to diversify your investment portfolio. Since gold often performs differently from equities and other assets, it can help balance your overall investment risk.

- No Wealth Tax: Unlike physical gold, Gold ETFs are not subject to wealth tax, providing a tax-efficient way to invest in gold.

- Small Investment Requirement: You can start investing in Gold ETFs with a small amount of money, making it accessible to a broader range of investors.

- Ease of Trading: Trading Gold ETFs is as simple as trading any other stock, making it a convenient option for both seasoned investors and beginners.

- Transparency: Gold ETFs offer transparency in pricing as they track the real-time price of gold, helping investors make informed decisions.

Now that you have a brief understanding of Gold ETFs and are considering investing in them, here are some key factors I look at when selecting the best Gold ETFs to buy in India

How to choose best gold ETF in India?

There is five parameters that you must check for selecting the best gold ETF in India

- Corpus

- Expense Ratio

- Tracking Ratio

- Traded Volumes/Liquidity

- Impact Price

Let’s explain these terms one by one in detail to have a clear idea in choosing the best gold ETFs that India has to offer

- Corpus: The total amount of assets managed by a Gold ETF. A larger corpus often indicates a more established and potentially stable ETF.

- Expense Ratio: The percentage of the fund’s assets used for operating expenses, including management fees and administrative costs. A lower expense ratio is generally preferable as it means less of your investment is eaten up by fees.

- Tracking Ratio: Measures how closely the ETF’s performance matches the price of the underlying gold. A higher tracking ratio indicates better alignment with the gold price.

- Traded Volumes/Liquidity: Refers to the average number of ETF units traded daily. Higher liquidity means you can buy or sell units more easily without significantly affecting the price.

- Impact Price: The price change of the ETF caused by a trade. A lower impact price means that buying or selling the ETF has a minimal effect on its market price.

Now moving on to the next topic in “What is gold ETF” where we will be discussing about the top 5 platform from where you can buy gold ETF from.

Best platform to buy gold ETFs in India:

Although there are many platforms available in India to buy gold ETFs, we will only be discussing the top five. At last I will be share my personal favorite platform, which I use to buy all types of ETFs.

Top 5 platform to buy gold ETF in India:

- Zerodha

- Groww

- 5 paisa

- Angel One

- kotak Mahindra Bank

Among the various options, Zerodha stands out as my personal favorite. I’ve been using it for two years, and its smooth fund transactions, low brokerage costs, and swift buying and selling features have kept me loyal.

Plus, Zerodha offers an impressive range of free tools for both fundamental and technical stock analysis, making it an invaluable resource for investors.

Now moving on to the next part in knowing “What is gold ETF ?” we will be discussing about the the essentials you require to buy ETFs through online platforms. Since I am a Zerotha user myself so I will only be able to assist you how I buy gold ETFs in Zerodha.

List of things to have to buy gold ETF in Zerodha:

- first you must have a demat account.

- Research gold ETFs on your broker’s website.

- Analyze the ETF.

- Then you must have sufficient capital mostly 3 times the capital that you are planning to invest in ETF.

- You must ensure to have detail data on ETF before making any purchase.

Since we have double checked the list of things that you must have to buy gold ETFs now let’s move on to the next topic in “What is gold ETF best way to buy in Zerodha?”

How to buy gold ETF in Zerodha?

There are two ways by which you can buy gold ETFs in Zerodha

- Limit order=In this ways we set the price at which we want to buy the ETF

- GTT order= Also known as good till trigger order where we first have to set the trigger price and the then the quantity of stock then at last the price at which you have buy the stock.

How to set limit order in zerodha for ETFs?

Here’s how to place a limit order in Zerodha for ETFs:

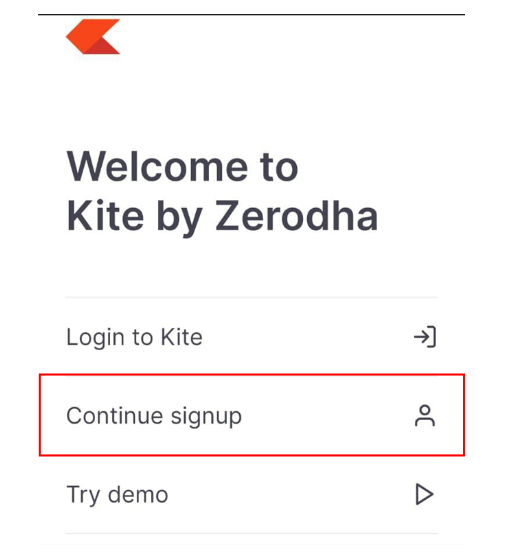

- Step 1= Log in to the Zerodha Kite app or website

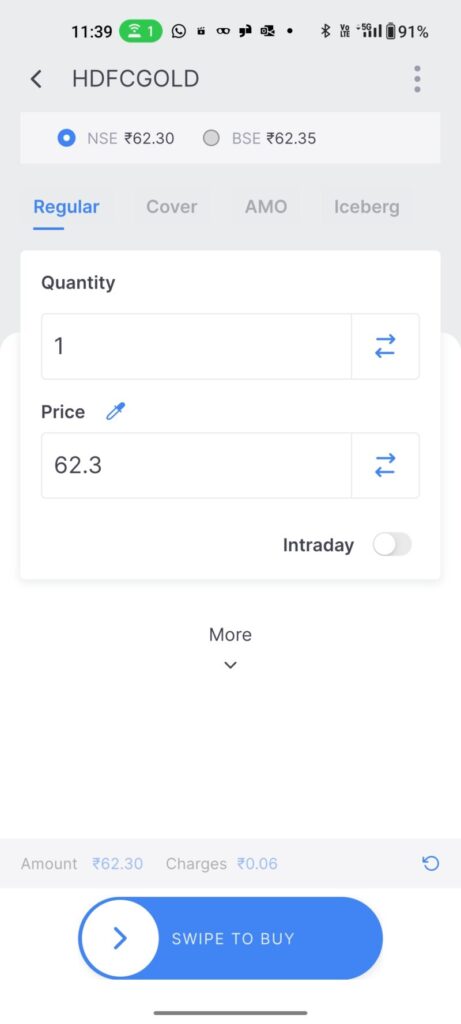

- Step 2= Select the ETF that you want to buy in watchlist of zerodha kite app.

- Step 3= Press buy button to set the limit order

- Step 4=set the quantity and the price at which you want to buy stock then Swipe to Buy slider on the bottom to conform the order.

Now, let’s move on to the next part in “What is Gold ETF,” where we were discussing another way of buying Gold ETFs in the Zerodha app.

What is GTT order?

The catch? If you no longer want the order to be active, you’ll need to manually cancel it. This extended timeframe gives you the flexibility to set your price and forget about it—until it’s triggered!

GTT, which stands for “Good Till Trigger” order, offers a distinct advantage over a standard limit order. While a limit order is only active for a single trading day, a GTT order remains in effect for up to one year, patiently waiting for your target price to be met.

How to set GTT buy in zerodha app?

Here are the ways how you can set the GTT order in zerodha . Steps for setting the GTT order is provided in sequence.

- Stem 1= Log in to the Zerodha Kite app or website

- Step 2 = Select the ETF that you want to buy in watchlist of zerodha kite app.

- Step 3=Press create GTT order that appear on the screen when you press on the stock.

- Step 4: Set the trigger price but it should be -0.25% low then the current price then select the quantity and then set the price at which you buy the stock.

For more details you can visit the official website of Zerodha or you can contact customer care of the company for more details.

Now as promised in the next part in knowing about what is gold ETFs I will be providing you my personal collection of top 5 best performing gold ETF in In in terms of volume , return and market cap the below list is arrange in the form of high to low market cap.

Which gold ETF is best in India?

There are vast verity of gold ETF available in the market but these are my personal favourites because of its performing in comparison with other gold ETFs in terms of volume and returns.

List of 5 Best Gold ETFs in India:

| Best Gold ETFs in India | Market Cap |

|---|---|

| GOLDBEES | 8,709 Cr |

| HDFCGOLD | 3,508 Cr |

| AXISGOLD | 790 Cr |

| BSLGOLDETF | 669 Cr |

| KOTAKGOLD | 3,161 Cr |

Best gold ETFs in zerodha:

Along with that, I’ve shared my personal favorite ETF, which has delivered high returns in just 3 to 4 months. This ETF also has high trading volume and a much lower price compared to other ETFs.

- Nippon India ETF Gold BeES. GOLDBEES. — 0.79%

- HDFC Gold Exchange Traded Fund. HDFCGOLD. — 0.59%

- ICICI Prudential Gold ETF. GOLDIETF. — 0.50%

- SBI Gold ETF. SETFGOLD. — 0.65%

- Kotak Gold Etf. GOLD1. — 0.55%

Now lets move on to the last topic of this blog about “What is gold ETFs” where we will be discussing about the mast asked question related to gold ETFs.

FAQ question:

Is it the right time to invest in gold ETF in India?

The best time to invest in gold or any ETF is when the the particular ETF is performing low as because ETF should always be bought at a low price.

Why to invest in gold ETF in India?

Reason for investing in gold ETFs is quite simple because of some reasons they are risk is low, cost is low ,returns are high and you don’t need to worry about the purity of gold as it is in the form of shares.

If you enjoyed this blog and would like to read more similar posts, here are the top 4 posts on my website. Take a moment to visit them and let me know in the comments if you find them interesting.

- What Are ETFs In India & Key Things For Investing In ETF 2024

- Pizza Galleria Profile: Gohana Brand (2015-2024) Detailed Overview

- Stage Company Profile:An Ott Platform Overview (2019 to 2024)

- Pizza Galleria Profile: Gohana Brand (2015-2024) Detailed Overview